Overnight millionaires, Lambos funded by dog-themed coins—this is the mad world of crypto speculation, a high-stakes frenzy that can make a sugar-buzzed five-year-old look downright calm. Welcome to memecoins, NFTs, and all those coin-flip opportunities that turn narratives like 'AI Monkeys' into an honest-to-goodness investment strategy. If you’re feeling a tad bewildered, don’t worry—it’s all part of the game.

But before we plunge headfirst into this whirlwind of monkey jpegs and overnight millionaires, let’s pause and talk about games. Specifically, we’ll talk about games like Hearthstone, a digital card game that is famous for introducing the phrase “RNGesus” into the gamer lexicon. Every so often, a new expansion comes along that wreaks total havoc on the meta, creating a dreaded “tier zero deck”—that’s basically code for “This deck is so broken and unbalanced that you can hear the developers weeping from space.”

Now, imagine a game like Hearthstone releasing a brand-new expansion every eight hours. Let that sink in. Every eight hours, you’d have to memorize an avalanche of new cards, re-figure your entire deck strategy, and then cry into your keyboard when an 11-year-old from across the world top-decks the exact card they need to pulverize you. That’s basically the pace of crypto markets. The big difference? When you lose here, it’s actual money on the line. Good luck sleeping tonight!

Crypto: The Zero-Sum Battle Royale

Part of what makes the crypto space such a white-knuckle ride is that it’s (usually) a zero-sum game. In other words, if I make a bunch of money from some newly minted, adorable Shiba-Inu-cosplaying-cat coin, that might mean someone else effectively paid for my gains by buying at the top—just in time for me to sell and run. It’s like playing musical chairs with your life savings: you really want to be sure you grab a seat before the music stops... or before the dev team “rug pulls” the contract, whichever comes first.

In typical financial markets (yes, the boring ones your parents keep bugging you about), information tends to be closer to perfect—meaning that big data feeds, algorithms, and an army of analysts keep everything fairly transparent (or at least attempt to). Yes, you’ll still find plenty of random price swings, but the markets generally move at a pace that lets you refresh your news app a few times a day and not hyperventilate into a paper bag.

Crypto, though, is a bit like an open-world game where every player is also the developer—constantly patching, exploiting bugs, and occasionally sending giant meteor strikes (a.k.a. “whale dumps”) at unpredictable intervals. You don’t just need the best gun in the game (or the best research and signals); you also need to survive a daily onslaught of new “meta” tactics—and if you blink too long, you’ll miss them. Oh look, a new chain just launched with a fancy yield farm! Let’s go dump everything we have into it and pray to the blockchain gods it doesn’t vanish tomorrow.

Adaptive or Deranged—Pick One

So is it any wonder that most crypto traders you meet appear... well, let’s just say “slightly unhinged”? They’re the folks who keep a dozen different market dashboards open at once, check their phone notifications at 3 a.m. just to confirm their NFT of a rainbow laser-eyed alpaca hasn’t sunk to zero, and can recite on-chain wallet addresses like their life depends on it.

It’s the same kind of reflexive mania you see in pro gamers who can sniff out an opponent’s location just by hearing a single footstep. And in fairness, that kind of reactivity and adaptability is a superpower in crypto. You want to seize that alpha as soon as it appears—before the rest of the crowd crashes in. It’s no coincidence that major runs or dumps happen around big news events, like developer announcements or influencer tweets (looking at you, Elon). That single tweet? It’s basically the bomb being planted in Counter-Strike—except, ironically, it’s your portfolio that might get defused.

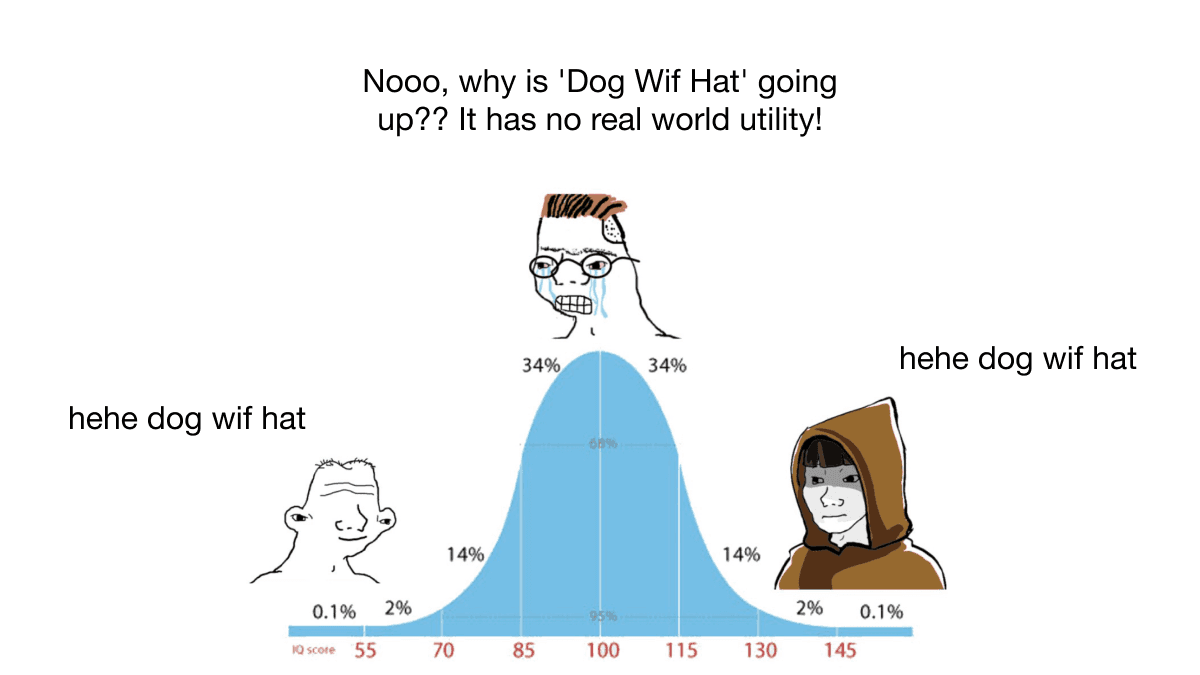

Everyone’s Trying To Be The Smartest

Now, in your average strategy game—be it Rainbow Six Siege or Connect Four—we’re dealing with finite, somewhat predictable strategies. When the bomb is planted at a certain spot, defenders have maybe three or four possible routes or tactics to regain control. Crypto is similarly limited, except it’s multiplied by social media hype and gobs of money—so it feels infinite while still being ironically constrained by human psychology.

You’ve got your usual suspects:

FOMO Warriors: They see a coin pump 200% in a day, sprint in, drop their life savings, and then panic-sell if it dips 5%.

Diamond-Handed Monoliths: They buy and never sell, often ignoring rational exit strategies because “to the moon, baby!”

Short-Selling Goblins: They rub their hands in glee every time a memecoin gets even a whiff of hype, ready to profit if it collapses.

Rug Pull Anarchists: They hype a project, vanish with the money, and reemerge under a new pseudonym—like some villain in a bad soap opera.

And then there’s you, presumably trying to figure out how to navigate these waters without your eyeballs turning into spinning dollar signs.

Lessons from the Wild West of Finance

Lessons from the Wild West of Finance

If you’re going to treat crypto like a 24/7, global, high-stakes video game, at least respect it for what it is—a mental marathon with real money at stake. Understand the risk, and don’t go in thinking you’ll always guess your opponent’s next move perfectly.

Adapt or Get Dunked On

Constant updates every eight hours? Yup, that’s crypto. Keep your finger on the pulse (or your phone’s news feed) if you plan to stay ahead, but maybe allow yourself a few REM cycles now and then. Sleep is still vital—you can’t trade effectively if you’re hallucinating that Vitalik Buterin is your dentist.

Know the Players, Know the Meta

Everyone wants to be the “smartest person in the room” here, which can lead to ironically stupid herd behavior. When the crowd is rushing in, consider whether it’s time to lighten your bags. When the panic sets in, maybe that’s your chance to buy. And remember: if you do exactly what everyone else does, you’ll get the same mediocre returns everyone else is complaining about.

Don’t Forget the Real Objectives

Just like the CSGO noob who tunnel-visions on kills while the bomb ticks away, it’s easy to chase quick gains and forget your broader goal. Are you investing for the long haul or short-term speculating? Do you actually like the project or just want to flip your NFT for profit? Keep sight of why you’re in the game at all—because if your only strategy is YOLO, well... YOLO often ends in oh-no.

It’s Mostly Zero-Sum

You’re not investing in a new service or building real-world infrastructure. In many cases, you’re playing a game of “Pass the Hot Potato” in a digital format. The price goes up when more people want the coin than those selling it, and goes down when the opposite happens. There’s no magic here—just a battle of wits, or lack thereof, between thousands of participants with varying degrees of knowledge (and possibly questionable hygiene).

“Speculation” Is Just Fancy Guessing—With Style

Calling crypto “speculative” is accurate, but it barely scratches the surface. Crypto speculation is a multilayered mind game driven by memes, hype, and the gambler’s buzz. It’s about predicting other traders’ moves in a market that can pivot faster than you can microwave a sad desk lunch.

Like in any game, you’ll sharpen your instincts with each defeat, refine your strategy, and maybe keep a plushie handy to hug when prices plummet. Remember: in crypto, the updates never stop, your rivals are worldwide, and the stakes get very real.

Now, if you’ll excuse me, I need to check Twitter for the next hot tip about a coin that promises to cure cancer with AI powered by hamsters.